News

- Details

- Written by Lisa Radinovsky

- Category: News

Vasilis Pyrgiotis, the new chairperson of the Copa and Cogeca Working Party on Olive Oil and Table Olives, recently discussed the Greek and European olive sector with Greek Liquid Gold, emphasizing the importance of pan-European cooperation and smart farming, as well as promotional campaigns—for example using branded olive oil bottles on restaurant tables.

- Details

- Written by Lisa Radinovsky

- Category: News

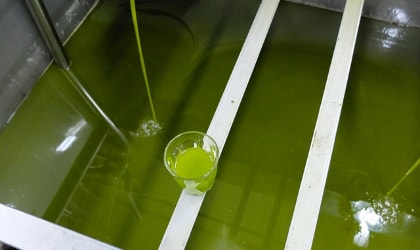

This year’s first World Olive Day event in Crete offered a glimpse of some Cretan olive oil sector activities, successes, and concerns. Scientists gave advice on olive oil extraction, trading, and olive mill waste management and reviewed developments in olive oil production and exports, then children presented a play, and olive mills received awards.

- Details

- Written by Lisa Radinovsky

- Category: News

A recent event hosted by the Chania Chamber of Commerce and Industry on "International Olive Oil Competitions: The Road to Distinction" revealed that the olive oil of the prefecture of Chania continues its upward course, both qualitatively and quantitatively. Drawing more than 65 participants, the event sparked the interest of many olive oil producers.

- Details

- Written by Lisa Radinovsky

- Category: News

The first estimates of the amount of olive oil to be produced by the major olive oil producing nations in the next crop year (October 1, 2017 to September 30, 2018) were published recently. While there is naturally some disagreement, and it is early to make predictions, a significant increase over this year’s olive oil production levels seems likely.

- Details

- Written by Lisa Radinovsky

- Category: News

Although recent news headlines warn of soaring olive oil prices, these increases are neither universal nor uniform. The world has seen lower olive oil production levels this decade, and excellent extra virgin olive oil is still available at prices that are more than reasonable given the work put into creating its high quality and striking health benefits.

- Details

- Written by Lisa Radinovsky

- Category: News

A good Greek extra virgin olive oil is “an amazing value for the quality of the product; it’s really well priced in the American market,” says American olive oil expert Alexandra Kicenik Devarenne. With a “great fondness for Greece” and an interest in Greek culture, Devarenne argues that “Greek olive oil hasn’t made the mark it deserves in the US market.”

- Details

- Written by Lisa Radinovsky

- Category: News

From New Orleans to Chicago, from Washington to London, headlines trumpet, “We’re about to suffer a worldwide olive oil shortage,” and “Olive Oil Prices Are Going Through the Roof”! Is it really that bad? Yes, olive oil production is down, demand and prices are up, but the numbers and supply in Greece and Spain suggest there is really no need to panic.

- Details

- Written by Lisa Radinovsky

- Category: News

A number of Greek extra virgin olive oils were recently recognized as some of the most highly awarded olive oils in the world, based on their success in international olive oil competitions. Greek olive oil producers consider these distinctions an affirmation of their hard work, attention to detail, and ceaseless efforts to create excellent products.

- Details

- Written by Lisa Radinovsky

- Category: News

“The unusual weather--snow, ice, and very low temperatures--affected almost all the major olive-oil producing areas” in Greece, according to the directors of the major Greek olive oil industry organizations, Panayiotis Karantonis (ESVITE) and George Economou (SEVITEL). Most importantly, they add, this weather hit after the olive harvest was mainly finished.

- Details

- Written by Lisa Radinovsky

- Category: News

On November 24, Fotis Sousalis, General Manager of Terra Creta olive oil company in Crete, Greece, was invited to make a presentation at the European Small and Medium Sized Enterprises (SME) Week celebration in Brussels. The event was hosted by the European Economic & Social Committee to highlight the key role SMEs play in Europe’s food and drink sector.

- Details

- Written by Lisa Radinovsky

- Category: News

Last June, the Olympia Health and Nutrition Awards initiated a new trend in olive oil competitions: a focus on health benefits. In 2017, the Olympia Awards will continue, the Aristoleo Awards will expand, a new competition will debut in Malaga, Spain, and the London Competition will lead mainstream competitions into this new health-conscious territory.

- Details

- Written by Lisa Radinovsky

- Category: News

On November 29, World Olive Day celebrations continued in Crete with a screening of the documentary "Cretan Olive Oil: The Secret of Longevity," remarks by local dignitaries, a lecture about the cooperation between the olive oil sector and tourism in Crete, a theatrical presentation by schoolchildren, and awards for hotels that promote Cretan olive oil.

- Details

- Written by Lisa Radinovsky

- Category: News

George Economou, director of SEVITEL, and Panayiotis Karantonis, director of ESVITE (the two main Greek olive oil industry organizations) expect Greece to produce about 200,000 metric tons of olive oil this year, a low amount “due to adverse weather conditions and the presence of diseases” that also caused problems with olive oil quality “in some areas.”

- Details

- Written by Lisa Radinovsky

- Category: News

Greek olive oil production is expected to fall to 200,000 metric tons or less for the 2016/17 crop year, with quality ranging from poor to excellent. Olive oil producers from different parts of Greece offer varying perspectives based on the situation in their area. Some are more optimistic about this crop year’s production level and quality than others.

- Details

- Written by Lisa Radinovsky

- Category: News

On November 26, at an informative, celebratory event honoring World Olive Day at the Mediterranean Agronomic Institute of Chania in Crete, Greece, the Association of Cretan Olive Municipalities (ACOM or SEDIK) presented awards to Cretan olive mills for their methods of olive mill operation, olive oil extraction, bottling, and olive oil distribution.

- Details

- Written by Lisa Radinovsky

- Category: News

The International Olive Council (IOC) decreed November 26 World Olive Day, for “seminars, trade fairs, or symposiums showcasing the relationship between olive products and health, olive growing and the environment, the history of olive growing, the olive economy, etc.” in IOC member countries. Various olive and olive oil events were planned in Greece.

- Details

- Written by Lisa Radinovsky

- Category: News

Twenty-one Greek extra virgin olive oils and two Greek flavored olive oils received Great Taste Awards in the United Kingdom this year. According to its website, the Great Taste Awards have been called “the ‘Oscars’ of the food world and the ‘epicurean equivalent of the Booker prize.’” Only 35% of the 10,000 products entered were awarded one or more stars.

- Details

- Written by Lisa Radinovsky

- Category: News

Aristotelis Azariadis is in the midst of an investigation of the effect of salinity and drought stress on four different olive cultivars, aiming to determine whether olive trees can be grown where we think they can’t survive. This is good to know in such places as Crete and North Africa, given a Cretan tradition of watering olive trees with sea water.

- Details

- Written by Lisa Radinovsky

- Category: News

Emmanouil Karpadakis, marketing manager and olive oil exporter at Terra Creta in Crete, recently returned from his second trip to South Korea. This time, he was participating in the EU-GATEWAY mission to promote EU organic products in Korea. Terra Creta was one of five Greek enterprises selected to participate in this expedition of 50 European companies.

- Details

- Written by Lisa Radinovsky

- Category: News

Even careful research yields a range of estimates, but a summary of the predictions of several individuals and organizations with substantial experience in the olive oil industry suggests that worldwide olive oil production is not expected to decrease more than 7 to 11% in comparison to last year, and major price increases are not anticipated.

- Details

- Written by Lisa Radinovsky

- Category: News

The strange combination of fewer table olives and lower prices for them in Halkidiki, northern Greece may mean more olive oil will be produced in that area, while farther south in mainland Greece there is some debate over expectations for olive oil prices based on early harvest Athinolia extra virgin olive oil sales in Lakonia, Peloponnese.

Links to Recent News Articles

-

Revised estimations and minor adjustments for global olive oil production in 2024/25 by 4E

Projections for the coming crop year's worldwide olive oil production from Olivenews.

-

Olive Trees on Corfu Face Threat from Wood-Eating Insects, Experts Rule Out Xylella

"A lab in Athens ruled out Xylella fastidiosa as the cause of the dieback in central and northern Corfu groves."

-

Olive oil under threat of EU ban

It is expected that "an upcoming European regulation will force olive oil producers to change their production methods or see their product labeled as unfit for consumption."

-

Farmers in Greece Witness the Impacts of Climate Change After Historically Low Harvest

"Farmers and millers throughout Greece have reported that climate change is making it increasingly difficult to produce award-winning extra virgin olive oil."

-

Olive oil companies join forces to export

"Investment fund SMERemediumCap of Nikolaos Karamouzis and Inspiring Earth of Konstantinos Antonopoulos are creating an export-minded giant in the Greek olive oil sector via a triple acquisition, with the total investment amounting to 10 million euros. By forming a joint company, which will acquire the majority package of the companies Latzimas SA, Sitia Oils-Lasitia SA and Olympian Green International SA, a new, powerful group in olive oil products is being created."

-

Promising Outlook for Olive Oil Production in 2024/25

"A global production of 3,200,000 tons restores the normal averages of the past, which will push market prices lower than today's levels."

-

Breaking away from selling olive oil in bulk

Greek olive oil producers interviewed for a major Greek daily newspaper explain how it's possible that "the Italians export 150% of the olive oil they produce" and discuss their efforts to bottle more Greek olive oil, rather than exporting it in bulk.

-

World market of olive oil and table olives – Data from April 2024

The International Olive Council's "overview of the latest sector statistics, including an update on olive oil prices, trends in international trade in olive oil and table olives, and producer prices for olive oil."

-

Olive oil production rises, while prices gradually fall

Tentative optimism about Greek olive oil for the next crop year.

-

Greek Court Rules Kalamon Olives May Use Kalamata Brand

After years of debate over use of the word "Kalamata" for Kalamon variety table olives, the Greek supreme court "rejected an appeal by Messenia-based growers that only they could use the Kalamata branding, an appellation worth €200 million in exports."

-

Global Production May Exceed Expectations, but Not Enough to Move Prices

"Analysts predict climate change will result in new price dynamics, with high-quality extra virgin olive oil and other market segments behaving differently."

-

Olive oil price soars 67% in one year

Regarding prices within the country: "Greece saw the second-highest increase in the price of olive oil since January 2023, with its 67% increase far above the European Union average of 50%, data from the EU’s statistics arm showed."

-

A Dismal Harvest Concludes in Greece

"With the country’s olive oil production almost halved compared to last year, record prices at origin have shaped a market searching for equilibrium."

-

Oil crisis: How olive farmers are adapting to climate change to preserve a cultural commodity

"Changing weather patterns are making it harder to grow olives across Europe, increasing consumer prices and threatening growers’ livelihoods." Farmers, researchers, and government officials are considering what to do about this.

-

Greece to Provide Work Permits to 30,000 Migrants to Curb Labor Shortage

Costas Vasilopoulos describes the Greek government's plan to reduce the shortage of agricultural laborers in the country.

-

Milestone in Olive Oil History: Auctioning “extrissimo” at €10.11/kg

One olive oil price record after another was broken in 2023; here is one from near the end of the year.

-

'Liquid gold’ rush: Greece’s surging olive oil price lures exporters — and thieves

An unusually well-considered, thorough article on the Greek olive oil sector, except perhaps Mr. Giannoulis's point was not accurately conveyed.

-

Farmers in Greece Call for Subsidies Amid Low Yields

"In Greece, olive growers and oil producers gathered outside regional government buildings nationwide, seeking financial aid to cope with this year’s extremely poor olive harvest."

-

The Scientific Society of Olive Encyclopaedists (4E) celebrates World Olive Day

Awards, a celebration, and an appeal from the Scientific Society of Olive Encyclopaedists (4E) on the occasion of World Olive Day.

-

“Along with Athena, you have to move your hand” (God helps them, that help themselves) was the message from 4E on World Olive Day

With this year's World Olive Day dedicated to the role of women, the 4E society awarded several Greek women for their special contributions to olive growing, and then discussed culture, environmental protection, olive oil quality, the health-nutritional value of olive oil and table olives, and whether olive oil is a luxury.

-

Production Soaring Expenses Strain Producers in Southern Europe

"Olive oil producers in Spain, Italy and Greece are grappling with challenges that threaten the viability of the sector."

-

Two Greek PDO Olive Oils Receive Protection in India

"Kalamata and Sitia Lasithiou Kritis extra virgin olive oils have been registered as in India to protect them from imitations."

-

Winter Isn't Coming: Climate Change Hits Greek Olive Crop

Climate change is threatening Greek olive production as trees suffer from a lack of cold, as well as less rain.

-

As price of olive oil soars, chainsaw-wielding thieves target Mediterranean’s century-old trees

More bad news about thefts in Greece: branches and even entire trees are being stolen, as well as olives.

-

In Greece, the price of olive oil soars, consumers panic

There is concern about the high price of olive oil and the low production levels expected this year in Greece.

-

Global Olive Oil Production Set for Second Straight Year of Decline

"The world’s seven largest olive oil-producing countries are expected to yield 1.97 million tons in the 2023/24 crop year, 23 percent below the average of the previous four campaigns."

-

High-Priced Olive Oil Fuels Thefts in Greece, Farmers Respond

Concerns about olive oil production, consumption, prices, and theft continues in Greece.

-

Cretan farmers combat rising olive theft with GPS technology

With olive oil's price higher than ever before, theft of oil and olives is a concern; this technology may help combat the problem.

-

Pricing Milestone: Fresh Greek Olive Oil Sells at 9.25€/kg

Some of the earliest harvest Greek extra virgin olive oil has sold for an astonishing price.

-

‘They don’t go for jewellery any more’: Olive oil theft on the rise in Greece

With olive oil prices 200% higher than last year in Greece due to climate-change induced shortages, theft of olive oil is increasing.

-

The International Olive Council Newsletter for August-September 2023

The newsletter includes news about the IOC’s collaboration with the USA and with the International Centre for Advanced Mediterranean Agronomic Studies (CIHEAM), plans for World Olive Day, olive groves’ ability to help fight climate change, revised IOC documents from the standardization and research unit, and data on the world market, including trade and prices of olive oil and table olives.

-

Tons of Olive Oil Stolen in Greece as Price of ‘Liquid Gold’ Skyrockets

Dozens of tons of olive oil were stolen from an olive oil farming cooperative's warehouse in Polygyros, Halkidiki; it is valued at over 370,000 euros.

-

Olive oil producers call for investigation into produce heist

"Twenty five olive oil producers who stored their production in an agricultural cooperative in Polygyros, northern Greece, from where it recently disappeared have filed criminal charges against unknown persons with the security police asking authorities to investigate how this happened and who is behind it."

-

Storms in Greece Flood Olive Groves, Damage Trees

As Costas Vasilopoulos writes, some olive trees were damaged by the rain and hailstorms in Greece that devastated the central part of the country with unprecedented flooding.

-

Unprecedented Heat Sparks More Wildfires Across Greece

As Costas Vasilopoulos writes, "Around 4,500 hectares of olive groves have been burned in wildfires across the country. The government promises aid, but farmers want something else."

-

In Greece, Olive Oil Remains Absent from Restaurant and Tavern Tables

Olive Oil Times recently expanded on an earlier Greek Liquid Gold article about olive oil on restaurant tables in Greece.

-

The Greek market of olive oil and table olives – current situation and 2023/24 perspectives

Vassilis Zampounis writes that the current situation points toward "a total production of 170,000-180,000 tons for the upcoming year" in Greece.

-

Europe Olive Oil Producers in Greece Brace for Steep Production Decline

"Warm weather, low fruition levels and the emergence of the fruit fly pose significant challenges to olive oil producers towards the next harvesting season."

-

Global Olive Oil Production Predicted to Rebound

"According to preliminary estimates from the United States Department of Agriculture, global olive oil production is expected to rebound in the upcoming 2023/24 crop year."

-

The global price of olive oil hit a 26-year high: Drought in Spain and elsewhere in the Mediterranean is stressing supply

"Heat and drought in the Mediterranean are harming production of olive oil, causing its price to spike," although "Greece is expected to boost its olive oil yield as the center of olive production moves eastward, thanks to rains and relatively mild temperatures."

-

The Greek extra virgin surpassed the psychological threshold of 6 €

A report from Olivenews about unusually high prices for Greek olive oil.

-

Greek Olive Oil Exports On the Rise

2023 is a good year for Greek olive oil, according to statistics shared by Ambrosia Magazine.

-

Europe Olive Oil Consumption in Italy, Greece Expected to Grow Amid Global Decline

"Olive oil consumption in Italy and Greece — two of the world’s largest producers — is expected to rise in the current crop year, according to data from the International Olive Council (IOC)."

-

Climate Change Threatens Chalkidiki Table Olive Producers, Research Indicates

Recent research in Greece shows that the expected effects of climate change should concern olive producers in the northeastern area of Chalkidiki.

-

Greece’s New CAP Plan Approved By European Commission

According to Costas Vasilopoulos, "the European Commission has approved Greece’s national strategic plan, which aligns with the latest revision of the E.U.’s Common Agricultural Policy (CAP)."

-

Olive Oil Production Gives Back to Environment More than it Takes

The latest research indicates that the carbon sink effect from olive trees in the biomass and soil is much higher than greenhouse gas emissions from production. (July 8, 2016)

-

News Briefs Persistent Warm Weather Causes Headaches for Olive Oil Producers in Greece

"Daytime temperatures remain around 20°C in many olive oil-producing areas of the country, undermining the quality of fresh EVOOs."

-

Olive Council Forecasts Significant Production Decline

Worldwide data on olive oil production for the 2022/23 crop year, as forecast by the International Olive Council for major producing countries.

-

Greece Set to Become Second-Largest Olive Oil Producer in Europe

This year, many olive oil producers in Greece are more hopeful than those in Italy and Spain.

-

Olive Fruit Fly Could Undermine Greek Olive Oil Production

"The fruit fly threatens expectations of a bumper crop. Experts suggest a change in established practices of fighting the pest."

-

Europe Rolls Out New Rules Governing Olive Oil Quality

Important news for olive oil bottlers about new European regulations.

-

Greek Prime Minister Pledges to Restore Amfissa Olive Grove

As the article says, "Konstantinos Mitsotakis, the Greek prime minister, has pledged to restore the Amfissa olive grove, one of several agricultural territories of the country that suffered extensive damages from wildfires in the summer."

-

Olive Oil Production to Fall 25%, European Commission Predicts

"All of Europe’s main producing countries, with the exception of Greece, are expecting significant production drops. However, some believe the forecast is too pessimistic."

-

Promising Signs of a Robust Harvest in Greece

"Contrary to other main European producers, Greece expects a substantial increase in its harvest yield. However, significant challenges could hamper the final tally."

-

Olive oil producer prices reach 4,90€/kg at the start of the new crop year in Greece

"Optimism is expressed that the prices will continue to be satisfactory so that finally all the available olive oils will be sold in a high average price (moyenne) during the whole crop year."

-

Bulk Exports from Greece Help Fuel the Italian Olive Oil Industry

A consideration of the role Greek olive oil plays in the Italian olive oil sector.

-

The Bid to Boost Olive Oil Quality on Crete

This article includes a very interesting video with scenes from an olive oil tasting lab, olive groves at harvest time, and a modern olive mill, as well as comments from several Cretans who work with olive oil. (Click on the CC button for English captions if you don't understand the Greek.)

-

Rising Olive Oil Prices Do Not Slow Consumption in Europe

Paolo DeAndreis summarizes some key points from an EU agricultural outlook report, pointing out, "Growing demand from households and the recovery of the foodservice sector are the main drivers increasing olive oil sales in the E.U."

-

Greek olive oil going Italian

"Local producers prefer to export their product in bulk to Italy without standardizing it."

-

Thousands of Olive Trees Donated to Restore Groves of Ancient Olympia

"More than 130,000 olive saplings have been donated to farmers in the area surrounding Ancient Olympia in the northwest Peloponnese, replacing some of the hundreds of thousands that burned in last summer’s devastating wildfires."

-

Flames Engulf the Ancient Olive Grove of Amfissa

"According to initial estimates, 30,000 to 40,000 trees were destroyed in fires that swept through some of the oldest olive groves in Greece."

-

Hellenic Center of Excellence for Health and Wellness Launches on Crete

"The Hellenic Center of Excellence for Health and Wellness, a non-profit initiative aimed at promoting Greek culture with a focus on the plant-based Mediterranean Diet, one of the world’s healthiest eating plans, was launched" on Crete in May.

-

Award Winners in Greece Discuss a Feverish Season Before a Bountiful Harvest

"The 2021/22 crop year required a swift harvest and milling due to unusually high temperatures. The coming crop year is shaping up to be better."

-

Global Olive Oil Production Expected to Slip to 2.9M Tons

Daniel Dawson reports on the USDA's forecasts for global olive oil production, consumption, and trade in the next crop year.

-

Olive Oil Market Stable in E.U. - Short-Term Outlook

"Despite the war in Ukraine, olive oil prices are expected to remain steady. E.U.production and consumption will rise. Exports will fall."

-

Campaign in Crete Urges Hospitality Establishments to Choose Local Olive Oils

Given the high price of sunflower oil due to the war in Ukraine, "Officials and olive oil professionals on the island want to encourage food entrepreneurs to use locally-produced olive oil in taverns, restaurants and hotels."

-

A Bittersweet Harvest Season for Greek Producers

A report on Greek olive oil production this crop year, and on predictions for next year. "Olive oil of high quality, medium quantity and average prices with increased production costs amid adverse weather were the main characteristics of the harvesting season in Greece."

-

Greece Registers Four PDO and PGI Olive Oils as Intellectual Property

"The Greek extra virgin olive oils were registered with an international organization that protects the product from imitation and counterfeiters in 56 countries."

-

Crisis Spurred Spartan Olive Oil to Forge a Brighter Future

"Sparta Gourmet’s high-tech mill is at the heart of a renewed local effort to produce high-quality olive oil" using a "sustainable and environmentally friendly" approach near Sparta, Peloponnese.

-

Campaign Aims to Replant Olive Trees of Olympia

An international nonprofit group is leading a fundraising campaign that aims to help replant olive trees after major fires destroyed olive groves in Ancient Olympia last summer. To find out how you can help, see https://olympia-trees.com/.

-

Harvest Unfolds with Mixed Results in Greece

Costas Vasilopoulos describes the results of this year's olive harvest in Greece, which vary from one place to another. In many areas, quality seems much better than quantity this year.

-

Global Olive Oil Production Will Reach 4.4M Tons by 2050, Expert Projects

"Intensive groves will outnumber traditional farms thirty years from now, and the number of olive oil-producing countries will rise to 80, says Juan Vilar."

-

Greeks Are Consuming Less Extra Virgin Olive Oil

"Greeks are among the top per capita consumers of olive oil in the world but have cut back on the highest grade." Based on an article about a 2020 survey in Greece, this report discusses various opinions, practices, and levels of knowledge about olive oil.

-

Producers on Crete Look to DNA Analysis to Add Value

"Local producers have joined forces with scientists In Chania, Crete, to identify, analyze and transfer the DNA identity of olive oil from the field to the bottle, achieving authenticity and traceability for their local products."

-

The Greek Scientific Society celebrates the World Olive Day

"Commentaries by five members of the Scientific Society of Olive Encyclopaedists (4E) on civilization, health and Covid-19, climate change, the value of olive growing, olive policy."

-

Heavy Downpours Dampen Harvest Outlook in Greece

"Many producing regions, especially in the western part of the country, were hit with a deluge that some farmers say is becoming more common." However, the situation varies in different parts of the country.

-

Heatwave, Deadly Fires Threaten the Approaching Olive Harvest in Greece

The total picture in the Greek olive sector is not yet clear, although "[t]he ongoing drought has led to wildfires burning around the country, damaging olive trees, and further diminishing the prospects of the 2021 harvest."

-

Olive Oil Production in Greece Expected to Slip

"Greek olive oil production will be off 20 percent from last year's yield, early estimates say."

-

Positive Signs for Olive Oil Sector in E.U. Report

"The progress in the Covid-19 vaccination campaign in Europe is positively affecting the recovery of the agricultural sector, according to the European Commission in its latest short-term outlook for agricultural markets."

-

Greece Requests Aid for Expected Drop in Olive Oil and Table Olive Production

"Greece has made an official request to the Council of the European Union to receive financial aid for oil olive oil and table olive producers hit by the extreme weather conditions that prevailed in parts of the country during the last six months."

-

New E.U. Ag Policy Could Benefit Greek Olive Growers If Requirements Are Met

"Greece will receive €19.3 billion under the new scheme, an amount similar to the funds provided by the CAP currently in operation."

-

2020/21 crop year: production down, consumption up

The International Olive Council reports on olive oil production and consumption this crop year.

-

Olive Oil Consumption Holds Steady as Production Slips, Latest Data Shows

"Despite the vast majority of the world struggling to contain the Covid-19 pandemic, global olive oil consumption did not falter, according to the latest report from the International Olive Council (IOC)."

-

Letter from Athens: Greek Olive Oil The Best But World Doesn't Know It

The Greek olive oil sector must get much better at promoting the national product, or it will continue to fall farther behind competing countries.

-

Consumption up everywhere but EU

The International Olive Council is studying olive oil consumption trends worldwide.

-

Greek olive oil producer sweeps awards in competition abroad

With 12 major awards at the Anatolian International Olive Oil Competition 2021 in Turkey, Sakellaropoulos Organic Farms has won more than 300 awards, a record for a Greek single estate olive producer.

-

Greek olive oil losing to Tunisian in Canada

"The insufficient promotion of Greek olive oil abroad, combined with the absence of a comprehensive policy to contain the cost of exports to far-flung countries like Canada, have resulted in a drop in Greece’s olive oil exports to the world’s second largest country."

-

Global Olive Oil Production Will Hit Four-Year High, USDA Estimates

"Increasing production paired with rising vegetable oil prices is also expected to yield record exports and olive oil consumption levels."

-

Producers in Greece Generate Electricity with Olive Mill Wastewater

"Producers can save money and be more sustainable by shipping olive mill wastewater to local biogas production plants." This article discusses the current advantages and limitations of this plan in Greece.

-

International Olive Council's Newsletter for October 2019

The begins by mentioning that 13 former Chairs and Vice-Chairs of the IOC Advisory Committee were formally recognized by the IOC “for their commitment to the olive sector and the role they played in the Advisory Committee.” These included Panayiotis Karantonis, Andreas Plemmenos, and Loukas Kollias from Greece. The newsletter then discusses imports of olive oil into Australia, where Greece is the 3rd largest supplier, after Spain and Italy. For table olive imports into Australia, Greece is by far the largest supplier “with 60.2% of the imported volume.” Next, the newsletter goes over the worldwide olive oil and table olive trade, noting that between October 2018 and July 2019 olive oil imports increased in Japan (23%); Russia (14%); Brazil (13%); China (12%); the US (9%); Australia (3%); and Canada (1%) compared to the same period the previous year. Extra virgin olive oil prices in the summer were lower than the previous year in Spain (20%) and Tunisia (18%), but similar to the previous year in Italy and Greece, with Italy bringing in by far the highest price and Spain the lowest.

-

Harvest Winds Down in Greece with Mixed Results

Compiled by Costas Vasilopoulos, these snapshots from different parts of Greece suggest varying results from the Greek olive harvest, with quality often better than quantity.

-

Greek Producers Await Reopening of Restaurants, Tourism

Snapshots from the Greek olive oil sector: selected views, as presented by Costas Vasilopoulos.

-

EU Agricultural Outlook for Markets, Income and Environment 2020-2030

Predictions for EU olive oil production, consumption, and exports in the next ten years are on page 42 (or 46) of this document, depending on which numbers you look at.

-

International Olive Council's Newsletter for October 2020

The International Olive Council’s (IOC’s) October 2020 newsletter includes news about the IOC’s meetings and projects, and about increases in olive oil imports, world trade in olive oil and table olives, and producer prices in September (lower than last year in the top four producing countries).

-

International Olive Council's Newsletter for November 2020

The International Olive Council’s (IOC’s) November 2020 newsletter includes news about the IOC’s meetings, a seminar, a course, table olive imports, world trade in olive oil and table olives, olive oil producer prices in late October (higher than last year for Spain, lower for Italy and Greece), and UNESCO’s designation of November 26 as World Olive Day internationally “to protect the olive tree and promote the values of peace, wisdom and harmony that it symbolises.”

-

Second Wave of Covid Hampers Harvest in Greece

This pessimistic article states, "A newly-imposed lockdown has brought Greece to a standstill and created a logistical nightmare for olive growers. Some health experts believe the start of the harvest is partly responsible for the spread of the virus." As Greek Liquid Gold's article on the same subject suggests, not everyone in the olive oil industry has such a negative view of the situation.

-

Prices Open Higher in Greece Amid Shortage of Laborers

According to Olive Oil Times, "Early seasonal prices have reached €3.80 per kilo while the lack of foreign workers has prevented some harvesting activities in Greece."

-

Olive Oil Prices - September 2020 update

The International Olive Council provides statistics about olive oil prices in Spain, Italy, Greece, and Portugal over the past decade.

-

Mounting Concerns in Greece as Harvest Nears

"The impacts of the COVID-19 pandemic and persistently low olive oil prices remain the biggest worries for producers."

-

Olive Oil Consumption Set to Outpace Production For a Change

"Worldwide olive oil production will be somewhat lower than consumption in the 2020 season."

-

International Olive Council's Newsletter for July 2020

The International Olive Council’s (IOC’s) July 2020 newsletter includes news about the IOC’s meetings, decisions, job openings, and PhD fellowship, ending with an overview of worldwide trade in olive oil and table olives. It includes a link to a document describing the procedures for organoleptic panels to follow during a pandemic.

-

'Elaiolado Makris' Gets PDO Status

New PDO and PGI designations from the European Union recognize this unique extra virgin olive oil's distinctive characteristics and specific origin in Thrace, northeastern Greece.

-

Olive Oil Industry Data Dashboard

An interesting, at times surprising, data source on worldwide olive oil production, consumption, imports, and exports from Olive Oil Times. Users can select specific countries for information about them.

-

Short-Term Outlook for EU Agricultural Markets in 2020

This European Commission publication includes points about olive oil on pages 5 and 21-22. For example: "Olive oil prices remain under pressure despite positive price signals after the activation of private storage aid, an overall EU consumption that could grow by 6%, and dynamic trade to all main export destinations. The 2020/21 EU production could be around 2.3 million t, thanks to good weather conditions in the spring in Spain that would compensate the impact of heat waves in Greece and a lack of rain in certain Italian producing regions."

-

U.S. Considers New Tariffs on European Olives and Olive Oils

Once again, as Paolo DeAndreis writes, "The United States Trade Representative (USTR) is reviewing existing tariffs and considering whether or not to impose new ones on goods imported from the European Union."

-

Exports see billion-euro slump in May

Olive oil is one of the exceptions; its exports increased both in May and in the first five months of 2020.

-

Proposed Standard Would Imperil Greek Exports, Trade Group Warns

There seems to be some concern in Greece about a new proposal for olive oil standards in the US. As a different article by Vassilis Zampounis (in Greek) points out, a new rule about the level of free fatty acids (among other things) could ignore other important factors that help determine olive oil quality.

-

Market situation in the olive oil and table olives sectors

Data from the European Commission, focused on Europe and its partners.

-

Unusual Spring Heat Brings Early Problems for Greek Farms

As Costas Vasilopoulos wrote for Olive Oil Times, "A heatwave during the critical flowering stage was enough to raise concerns among growers for their expected yields."

-

Olive Oil – Estimates 2019/20 Crop Year

The International Olive Council has published estimates for olive oil production in the current crop year.

-

USDA Predicts Global Olive Oil Production To Decrease Again

Very early expectations for worldwide olive oil production and consumption in the upcoming harvest year.

-

Olive Oil – Provisional Data 2018/19 Crop Year

The International Olive Council has published provisional data for the previous (2018/19) crop year.

-

E.U. Anticipates Increase in Consumption and Exports by 2030

The EU's predictions for olive oil in the coming decade (the Olive Oil Times report).

-

National Treasure Loss, Greece Not Marketing Olive Oil Wealth

"With its world-class olive oil winning kudos and awards in contests and a country whose very symbol is the olive tree, Greek producers and governments have let the international market slip away to countries and lesser brands."

-

Despite Tariff Exemption, Greek Producers Struggle to Export Their Oil

"With U.S. tariffs on some Spanish olive oil imports coming into force, Greek producers should have an advantage over Spain. However, the nation has not been able to profit from exporting its olive oil" much in the past.

-

Producers in Crete Stunned by Precarious Crop

"A sudden outburst of the fruit fly and other pathogens inflicted unexpected damage on the island's farms."

-

Dimitra Alieos talks to Vasilis Zampounis about the strong and weaker aspects regarding the place of Greek olive oil in the international market

An in-depth, informative article based on an interview with an international expert. It includes worldwide production estimates for the 2019/20 crop year.

-

International Olive Council's Newsletter for September 2019

The newsletter begins with an overview of IOC meetings and workshops planned for October, including one finalizing a collaboration between the IOC and the University of Jaen. A noteworthy result of that collaboration: “The IOC expert course on the organoleptic assessment of virgin olive oils will now be taught in English as well as Spanish.” A section on Canada shows that imports of olive oil--especially virgin—and olives have increased considerably since 2005, with about 5% of world imports of each going into Canada (a bit less for olives, but Greece is the second most important table olive supplier for Canada). Surveying the world trade in olive oil and table olives, the newsletter notes increased imports from October 2018 to June 2019 (compared to the same period in the previous year) in Japan (22%); Brazil (14%); Russia (13%); China (10%); the US (9%); and Australia (7%), with a decrease only in Canada, and only by 1%. Producer prices for olive oil were down (compared to the previous year) in the main producing countries in the summer, except for a 17% rise in Italy.

-

Exemption from U.S. Tariffs Creates Opportunity for Greek Exporters

"Recently imposed tariffs on some Spanish olive oil exports to the United States could help Greek producers and exporters increase their presence in the lucrative U.S. olive oil market."

-

Greece fails to harvest its olive oil wealth

"The world’s third biggest producer is not generating the export earnings that it should." An unusually well-considered, in-depth, but not very encouraging discussion of the state of the Greek olive oil sector today.

-

Greeks Optimistic About Upcoming Harvest

Many Greeks expect a good olive harvest this year.

-

Spanish Olive Oil on Final List of Retaliatory Tariffs on E.U. Goods

Sad news for Spanish olive and olive oil producers and exporters--although the tariff could have been higher--but good news for Greeks and other Europeans, whose olive oil is not affected.

-

Production falls, will prices go up (and when)?

In a usefully detailed discussion on Olivenews.gr, Vassilis Zampounis writes about expectations for the coming crop year's Greek olive oil production. "While the initial estimations were at 300 thousand tons, we are now looking at 240" thousand metric tons of olive oil from Greece this year. However, he adds a crucial point: "What should be emphasized though, is the spectacular improvement in quality compared to 2018/19." (The question about price increases should not alarm consumers, as it refers to currently very low Greek producer prices more than the cost in stores.)

-

International Olive Council's Newsletter for August 2019

The International Olive Council’s (IOC’s) Market Newsletter for August begins with an overview of the world trade in olive oil and table olives for October 2018 to January 2019. It notes increased olive oil imports in Japan (23%); China (15%); Brazil (14%); Australia (13%); Russia (12%); the USA (8%) and Canada (4%) compared to a year earlier, and increased table olive imports in four major importing countries from September through May. The newsletter also discusses producer prices during the summer in four major olive oil producing countries, with 18% decreases for extra virgin olive oil in Spain and Tunisia compared to the same time last year, a 4% drop in Greece, and a 17% increase in Italy, where prices are by far the highest.

-

Olive Oil is Key to Promoting Plant-Forward Diets, Report Says

Daniel Dawson writes that the Culinary Institute of America and International Olive Council "believe that increasing olive oil consumption is a complementary goal to promoting a shift toward plant-forward cooking," which could help fight climate change.

-

Congressional Support in the Fight Against Olive Oil Tariffs

The North American Olive Oil Association's report on an appeal to the United States Trade Representative by 19 American Congresspeople who urged that olive oil be removed from a list of products that could be subject to US tariffs on European imports.

-

International Olive Council's Newsletter for July 2019

The International Olive Council’s (IOC’s) Market Newsletter for July mentions a seminar in Marrakech, Morocco, the IOC’s participation in the 42nd session of the Codex Alimentarius in Geneva, Switzerland, and the presentation of the Mario Solinas Quality Awards in New York. It includes an overview of the IOC’s collaboration with the Culinary Institute of America (CIA) to present “The New Olive Oil Kitchen” in New York City in June. Part of the IOC’s promotion campaign in the USA, this featured a discussion of “‘Olive Oil and the Plant-Forward Kitchen,’ which presents olive oil as a key component of the Mediterranean diet that can provide inspiration for contemporary American cooking” as well as being important in a healthy, sustainable cooking trend elsewhere. The newsletter also describes a seminar the IOC co-organized entitled “Olive-Oil Supplemented Diet: Impacts on Cancer, Diabetes and Cardiovascular Health.” It then discusses the world’s major importer of olive oil, the USA. It concludes with a summary of major points about world trade in olive oil and table olives in the 2018/19 crop year, including increased olive oil imports in Japan (25%), Australia (16%), Russia (16%), Brazil (15%), China (12%), and the US (9%), and olive oil producer prices in June, which were 40% higher in Italy, 19% lower in Spain, 18% lower in Tunisia, and the same in Greece, compared with the previous year.

-

Researchers Isolate EVOO Component With Potential Antihypertensive Properties

"Researchers from the Department of Pharmacognosy of Athens University in Greece, have managed to detect and isolate a constituent of extra virgin olive oil that could act against high blood pressure."

-

New Funding for Research on Dementia and MedDiet

"Researchers from Swinburne University received funding to continue investigating the links found between adhering to the Mediterranean diet and a reduced risk of dementia."

-

EU-Mercosur Agreement Paves the Way for Tax-free Agricultural Trade

Assuming it is ratified, this agreement could make a difference for European olive oil exports to four Latin American countries.

-

International Olive Council's Newsletter for June 2019

The International Olive Council’s (IOC’s) Market Newsletter for June opens with an overview of the 109th session of the council of members, which took place in Morocco, the focus of the newsletter’s next article and of the 125th edition of the IOC’s Olivae magazine. The newsletter discusses the IOC’s seminar on the future of the olive sector, an expert meeting on possible contaminant residues in olive oils and olive-pomace oils, and the imports of olives and olive oil in Brazil (where olive oil imports from Greece have increased considerably). Concluding with a look at the world trade in olive oil and table olives, the newsletter mentions that data on olive oil and olive pomace oil imports from October 2018 to March 2019 “show an increase of 19% in Japan; 18% in Australia; 16% in Russia; 13% in Brazil; 11% in the United States; 6% in China; and 2% in Canada.” Extra virgin olive oil producer prices at the end of May were down 12% in Spain and 18% in Tunisia compared to last year, but up 4% in Greece and 49% in Italy.

-

First Estimates for 2019/2020 World Olive Oil Production Released in Spain

And now in English: very early estimates for the 2019/20 crop year's olive oil production worldwide, and in the major producing countries.

-

The "Aristoil" Program Distinguished In Europe

The European program Interreg Med Aristoil was "selected as the best program in its category for 2019 among dozens of interregional European programs." As the article says, "the aim of the ARISTOIL program is to increase the economic value of olive oil through demonstration and certification of its health protective properties and directly concerns more than 3000 olive growers participating in the program."

-

Greek Olive Oil Exporters Alarmed Over Proposed US Tariffs

As Helen Skopis writes for Greek Reporter, there is concern in Greece about the possibility that US tariffs could be imposed on European olive oil, but also hope that this will not occur. Note the link (at the end) to a petition which urges avoidance of what the North American Olive Oil Association (NAOOA)'s executive director, Joseph Profaci, says would amount to a tax on the health of Americans.

-

“Open Dialogue for the Greek Olive Oil” Event

A brief overview of a recent important meeting in the Greek olive oil world, from Olivenews.gr.

-

14 Greek Olive Varieties to Be State Certified

"The certification process for 14 varieties of olive is underway at the state-run Olive Tree Institute of ELGO Demetra based in Chania, a development that Greek Nurseries are watching with great interest but also caution as it could satisfy their long-standing demand for certified propagating material."

-

International Olive Council's Newsletter for May 2019

The International Olive Council Market Newsletter for May 2019 opens with a focus on Egypt (the world’s leading consumer and 2nd producer of table olives) and news from the latest meeting (in Cairo) of the IOC Advisory Committee. News from Egypt comes with information about table olive consumption and production worldwide. The newsletter goes on to discuss a course on table olives in Egypt, a conference and meetings in Peru, and visits to the IOC from a Chinese delegation and the Olive Oil Sommelier Association of Japan. There is an overview of trade in olive oil and table olives in eight markets from October to February 2019, showing increased olive oil imports in Australia (21%), Japan (19%), Russia (19%), the USA (17%), Brazil (15%), and Canada (7%), with imports falling only in China (4%) compared to last year. There were more modest increases in imports of table olives in four countries. The newsletter concludes with a look at producer prices for olive oil in the major producing countries. Prices fell in Spain (21%), Tunisia (18%), and Greece (10%) compared to last year but continued their climb in Italy, where they are 48% higher than last year.

-

No Consensus on This Year’s Production in Greece

"Estimates of this year’s olive oil production by key stakeholders offer contrasting pictures of the quantities of extra virgin olive oil that may be available on the Greek market for this season."

-

Family Business From Sparta Wins its 100th Prize for Olive Oil Production

Sakellaropoulos Organic Farming recently won its 100th award for its organic products, including its olive oil. "It is the only Greek business which has managed to win such a large number of prizes and awards in an array of worldwide shows and competitions."

-

International Olive Council's Newsletter for April 2019

The International Olive Council’s Market Newsletter for April 2019 begins with a focus on the Mario Solinas Competition, which seems to have been largely a contest among Spanish, Portuguese, and Moroccan olive oils this year, with a handful of entries from ten other countries. The newsletter also discusses “a meeting on the organoleptic assessment of virgin olive oil at IOC headquarters in Madrid” concerning “recent updates on organoleptic assessment, sensory analysis panel harmonization and the classification of virgin olive oil.” It mentions plans to launch “a portal that gathers scientific information on the health benefits of olive oil and olive products,” the Olive Health Information System, or OHIS, “in the coming months.” It includes a market report that shows increases in olive oil imports in several key markets from October 2018 to January 2019: Australia (31%), Japan (18%), Russia (17%), Brazil (13%), and Canada (12%); Australia, Brazil, and Canada also increased imports of table olives. Some of the dates in the discussion of olive oil producer prices seem rather mixed up, so those interested may want to consult the graphs at the end of the newsletter.

-

Olive Oil Drives Growth of Greek Agri-food Sector

"Olive oil was the largest Greek agri-food export last year and the fourth-largest export overall, according to a new report. Its success has renewed the call from farmers for government backing."

-

Man With Prostate Cancer Placing His Beliefs on Power of Olive Oil

Interested for years in "the health benefits of phenolic compounds in olive oil, ... [Athan] Gadanidis had told Dr. Magiatis that they needed a human subject to test the benefits of olive oil in treating prostate cancer. Ironically, he would be that subject himself."

-

Olive Oil Production Data in Europe Reveal Divergent Trends

With olive oil production considerably decreased in Italy and Greece but increased in Spain and Portugal, this article offers food for thought about reasons and responses. It also notes that quality remains high in Greece and Italy.

-

International Olive Council's Newsletter for March 2019

The International Olive Council newsletter for March opens with a look at developments related to olive oil in Albania, Japan, China, and Poland. It continues with an Open Call for Experts “and laboratory leaders working on possible contaminants in olive oils and olive-pomace oils to express their interest in participating in data collection and method validation.” The newsletter moves on to world trade in olive oil and table olives, with a focus on Japan, the fourth largest importer of olive oil in the world, mostly from Spain and Italy, with imports up by 18% in the first three months of the crop year, compared to last year. More generally, trade in olive oil and olive pomace oil began the 2018/19 crop year with significant increases in the first three months (October – December 2018): “28% in Russia; 25% in Australia; 18% in Japan; and 15% in Brazil.” Table olive trade also increased in some countries. Extra virgin olive oil producer prices remain considerably lower than last year in Spain (25%), Tunisia (18%), and Greece (14%), but much higher in Italy (46%).

-

International Olive Council's Newsletter for February 2019

The International Olive Council newsletter for February has a new look and quite a lot of information about past and future meetings (in Egypt, Japan, Germany) and projects (the Horizon2020 project called OLEUM). Noteworthy: “the International Olive Council plans to award 20 scholarships for the university specialisation course in the organoleptic assessment of virgin olive oil (university expert diploma) taught at the University of Jaén (Spain).” Applications are due March 15, and this is open only to those fluent in Spanish, the language of instruction. Italy has proposed a new classification for extra virgin olive oil, which it suggests be limited to olive oil with an acidity of no more than 5% (instead of the current 8%). “A proposal must be officially presented to the [IOC] Council of Members so that the Executive Secretariat can take the steps necessary to study the issue at hand.” In market news: worldwide table olive consumption has increased by 178.7% since 1990. In the first two months of 2018/19 crop year, October to November 2018, eight markets increased their olive oil imports, compared to the same time last year: Australia (38%), Brazil (31%), Russia (25%), Japan (19%), Canada (15%), and China (5%). Extra virgin olive oil prices in Italy have continued to increase and remain far higher than in Spain, Greece, and Tunisia.

-

Greek Producers Report Poor Harvest for Quantity, Quality

This confirms expectations that this difficult crop year, due to weather and olive fruit fly problems, means less olive oil from Greece, with quality problems in many areas. On the other hand, Ioannis Kampouris says, "The producers who devoted time to cater to their groves and executed precise crop-dusting operations received olive oils of high quality, provided that harvest and processing of the olives occurred on time.... So, instead of the usual mass production, small producers will be able to demonstrate their quality products.”

-

2018 Harvest Survey Reveals Season Marked by Climatic Challenges

This Olive Oil Times article avoids the overgeneralizations we see in most publications about the current olive harvest year, showing that the situation in several countries is more complicated than many think.

-

Bears and Tigers

Vassilis Zampounis writes in Olivenews.gr that the Greek olive oil market is now characterized by low demand and low prices, since excellent extra virgin olive oils (EVOOs) are much less common than last year, with some exceptions for very high quality EVOOs in Laconia and Crete.

-

International Shortage of Olive Oil to Be Compensated by Spain

Danielle Pacheco provides an overview of the big picture of olive oil production this year according to European Commission figures, with Greece producing the 2nd largest amount of olive oil, after Spain, and the total production worldwide not too much less than last year.

-

Spain stays behind

Vassilis Zampounis writes in Olivenews.gr that "official information from the Spanish Ministry" leads him to expect 1.6 million metric tons of olive oil from Spain this crop year, rather than the more optimistic 1.76 million estimated by the European Commission.

-

The Rise of Organic Olive Oil in Greece

"Small-scale Greek producers are taking a gamble that the risk of investing in organic olive oil production will pay off. Some say Greece has the ideal conditions in which to do so."

-

Bari Meeting on Xylella Lays Down Joint Action Plan

As Ylenia Granitto writes for Olive Oil Times, "the International Olive Council and the International Center for Advanced Mediterranean Agronomic Studies organized a seminar with the goal of consolidating a common action plan against Xf." (Xylella has not been reported in Greece to date, but vigilance is encouraged.)

-

International Olive Council's Newsletter for November-December 2018

At the 108th meeting of the Council of Members of the International Olive Council (IOC) in November, the rotating leadership was transferred from Argentina to Egypt. In the context of a World Olive Day celebration, the newsletter offered an overview of who is involved with the IOC, and what the IOC does. At a CO2 International Seminar, the IOC’s algorithm to calculate the carbon footprint of olive oil was presented and discussed, and additional research on olive trees’ ability to extract carbon from the atmosphere was encouraged. The topics covered at the 52nd meeting of the Advisory Committee on olive oil and table olives were mentioned. The rest of the newsletter focused on world trade in olive oil and table olives, noting a significant decrease in olive oil imports in the 2017/18 crop year in Brazil and Canada and a slight decline in the USA, and discussing fluctuations in olive oil prices through mid November, as compared to the previous year.

-

Cretan Olive Oil Sells For €1,020 per Liter at Dutch Auction

A 500-ml bottle of extra virgin olive oil made from the olives of ancient trees around Ierapetra, Crete was sold recently for €510 at an auction in the Netherlands.

-

Lower Volumes Forecast As Harvest in Greece Hits Its Stride

Costas Vasilopoulos provides an overview of expectations for this year's Greek olive oil production in Olive Oil Times, noting that "a reduction in quality and quantity is expected in the majority of olive oil making territories compared to last year."

-

Revision of olive oil balance

Vassilis Zampounis updated his expectations for olive oil production from the major Mediterranean producers on Olivenews.gr. The big picture, worldwide, is better than he had expected earlier, although that is not true for Greece.

-

Global Olive Oil Production to Dip in 2018/19

Earlier forecasts called for less olive oil production worldwide this year; what is noteworthy here is that the decrease now looks like 5.5% rather than the more concerning 8% drop predicted earlier.

-

High Phenolic EVOOs Big Impact at SIAL Paris 2018

The Aristoleo team took some high phenolic extra virgin olive oils to SIAL Paris recently, showcasing some extra healthy EVOOs on the world's stage.

-

International Olive Council's Market Newsletter for October 2018

The International Olive Council’s (IOC’s) Market Newsletter for October begins with an overview of Brazilian olive oil imports (only 1% from Greece), a September meeting about how to “to prevent, control and mitigate the effects of the bacteria Xylella fastidiosa (Xf) in olive trees” and a December seminar on “Integrated Action against Xylella fastidiosa to Protect Olive Trees and International Trade,” then moves on to world trade in olive oil and table olives. Notable figures for October 2017- August 2018 include a 28% in imports of olive oil into Brazil and 16% increase into Canada, and an 89% increase in imports into the EU, especially from Tunisia. OIive oil producer prices fell slightly in Spain and Greece in recent weeks, while passing 5 euros per kg by mid October in Italy.

-

Τα πρώτα ελαιοτριβεία λάδωσαν

In this article (in Greek), Vassilis Zampounis reports that the powerful Xenophon and Zorba storms that hit Greece this fall led to reduced expectations for the country’s olive oil production; instead of the 240,000 metric tons he predicted before, he now expects 210,000 from Greece. On the other hand, his prediction for Italy is unchanged at 190,000, while the forecast for Spain has improved, going up to 1.6 million metric tons.

-

Untapped potential in Greece’s food and agricultural sector

Naturally, this includes the olive and olive oil sectors. Solutions mentioned here and elsewhere include increased branding (vs. bulk sales), promotion of PDO products, and links to agrotourism ventures.

-

A New ‘Greek Mark’ for Olives and Olive Oil

"Seven companies in Greece that produce table olives and extra virgin and virgin olive oil were the first in the country to display a 'Greek Mark' on their labeling, part of a project to distinguish Greek products in foreign markets."

-

Olive oil’s health benefits explored at Yale School of Public Health symposium

This is an interesting summary of many of the topics covered at the recent conference at Yale School of Public Health, which convened a committee to plan a new olive institute at this prestigious American university.

-

International Olive Council's Market Newsletter for September 2018

The IOC reports on provisional data for global olive oil production for the 2017/18 crop year, with 3,315,000 metric tons produced overall, which is a 28% increase compared to the previous crop year, and a 9% consumption increase. The major producing countries for 2017/18 were Spain (1,256,200 metric tons), Italy (428,900), Greece (346,000), Tunisia (280,000), Turkey (263,000), Morocco (140,000), and Portugal (134,800), according to figures provided by each country. Except for Spain, whose production had fallen by 2.7%, each of these countries enjoyed a significant increase in production compared to the previous year, although the increase varied from 27% in Morocco to 180% in Tunisia. “According to the official country data and the estimates of the IOC Executive Secretariat, world production in 2018/19 is estimated at around 3 064 000 t, which would be a decrease of approximately 7.6% compared to the previous year. Consumption is expected at 2 916 500 t…. At this point in the year it is still too early to judge the accuracy of these estimates and the figures that the Council of Members will examine at the end of November will be more solid, unless exceptional weather conditions intervene.” Specifically, these are the current forecasts for major producing countries: Spain, 1,550,000 metric tons; Italy, 270,000; Greece, 240,000; Turkey, 183,000; Morocco, 145,000; Portugal, 130,000; Tunisia, 120,000. For table olives, “world production for the 2018/19 crop year is estimated at 2 735 500 t, a 7% decrease compared to the previous crop year.” Tables provide an overview of imports of olive oil and table olives during most of the 2017/18 crop year, and graphs show major producer countries’ olive oil price fluctuations over the last few years.

-

Olive Oil Production Up More Than 25 Percent, Consumption Edges Higher

This is Daniel Dawson's summary for Olive Oil Times of the International Olive Council newsletter I also summarized a bit differently above.

-

In Greece, Olive Trees Suffer From Fruit Fly Infection Ahead of Harvest

Compared to last year, the Greek olive harvest is "expected to be slimmer mainly due to the production cycle of the olive trees, and the olive fruit fly has again made its presence felt in many areas of the country." However, some growers are more hopeful than others; the situation is not uniform throughout the country.

-

Yale to Host Conference on Olive Oil, Plans to Establish Research Center

As Daniel Dawson writes, "The conference will gather industry members from an array of disciplines to plan the formation of an olive oil think tank."

-

E.U. – Japan Trade Deal Brings Opportunities to Olive Oil Exporters

As Costas Vasilopoulos writes for Olive Oil Times in his summary of some of the benefits of the new deal, "By discarding its own labeling rules and by adopting the rules of the IOC, Japan will make it a lot easier for bottlers and exporters to send their olive oils to this part of the Far East.... The Office for Economic and Commercial Affairs of the Greek Embassy in Tokyo told us that they foresee an indirect benefit for olive oil from the opening of the Japanese market to EU products, which will prompt consumers to opt for more products from the EU member states."

-

International Olive Council's Market Newsletter for July-August 2018

This edition of the International Olive Council’s (IOC’s) Market Newsletter provides an overview of the IOC’s upcoming activities and meetings, including some leading up to World Olive Day on November 22. For example, the IOC’s Statistics Working Group will meet October 1 to discuss estimates for the upcoming and past harvest years, among other topics. Olive oil chemistry and standardization issues, categories, and debates will be addressed at a number of meetings. The newsletter also provides an overview of olive oil trade from October 2017 to June 2018 (and table olives during a similar period), noting a 29% increase of olive oil imports into Brazil and a 98% increase in imports into the European Union from outside the EU, mainly from Tunisia. Changes in producer prices in major olive oil producing countries are also summarized, with significant reductions compared to the same time last year (26-27% less for Greece, Italy, and Spain, 18% less in Tunisia) and considerably higher prices in Italy than in the other three.

-

Restaurants in Greece Slow to Adopt New Rules for Olive Oil Service

"Six months after the new rule banning refillable bottles, the restaurants who apply it are still an exception." However, the owner of one exception emphasizes the important goal of the law.

-

Greek Trade Group Proposes National Strategy for Olive Oil

"The National Interbranch Olive Oil Association unveiled a strategy to create a stable environment and boost exports."

-

First estimations for the 2018/19 production

Vassilleios Zampounis's first predictions of how much olive oil there will be in the next harvest year, starting this fall, on his Olive News website.

-

International Olive Council's Market Newsletter for June 2018

At the 107th session of the International Olive Council (IOC) Council of Members in Buenos Aires (Argentina) from June 18-21, the council discussed updated data on olive oil and table olives for the 2016/17 and 2017/18 crop years (provided here for olive oil). After the council meeting, the IOC and “the Argentine authorities held an international seminar on the olive oil sector in the Americas.” After summarizing what was covered there, the newsletter goes on to discuss world trade in olive oil and table olives, noting changes in imports in major countries from October through April, including a 29% increase of olive oil imports in Brazil, but a 17% decrease of imports in Australia. The newsletter ends with a discussion of olive oil producer price changes in Greece, Italy, Spain, and Tunisia, where prices are all considerably lower than they were a year ago (28-31% lower in the European countries, 18% lower in Tunisia). Prices in Italy and especially Tunisia have been relatively stable in recent weeks, with a slight increase lately in Italy, while prices in Spain and Greece had been falling, then increased a bit in Spain while stabilizing in Greece, according to an IOC chart in the newsletter.

-

Plan by experts to boost Delphi’s olives in the works

Greek scientists in Greece and at Yale University "conducted a study in which they propose measures to advance sustainable olive oil production and advertise the nutritional value of olive oil products, as well as for the creation of a park and museum on the subject in the town" of Delphi, and both Greek officials and Yale University support the proposal.

-

International Olive Council's Market Newsletter for April 2018

The International Olive Council's Market Newsletter for April provided updated statistics for olive oil and table olive production in the 2017/18 crop year, mentioned an upcoming international seminar on the Olive Sector in the Americas (June 22, Buenos Aires), discussed promotion campaigns in China and Australia, and offered an overview of world trade in olive oil and table olives, as well as recent trends in producer prices. One noteworthy statistic: "World production (Graph I) for this campaign was estimated in November 2017 at 2 988 500 t, but according to the most recent country figures received, production stands at around 3 271 000 t, which is a 27% increase (+697 000 t) compared to the previous crop year."

-

Scientific Society of Olive Encyclopaedists (4E) officially launched

A new society has been established in Greece to support development, promotion, collaboration, and education "to improve the prospects of the Greek olive sector, while shaping a better environment for the flagship products of Greece: olive oil and table olives."

-

International Olive Council's Market Newsletter for May 2018

The International Olive Council’s (IOC’s) Market Newsletter for May 2018 opens with a focus on olive and olive oil production, harvesting, consumption, exports, and varieties in Argentina, which currently holds the IOC presidency and will host the IOC’s session of the Council of Members June 18-21. The newsletter then provides an overview of world trade in olive oil and table olives. It discusses olive oil imports in 8 major markets this harvest year, with a significant increase in Brazil (21%), a major decrease in Australia (19%), and smaller changes in other countries. Table olive imports had mainly modest changes. Producer prices for extra virgin olive oil are more than 30% lower than the same time last year in Greece, Italy, and Spain, and down 19% in Tunisia.

-

World olive oil production could absorb the CO2 emissions of a city the size of Hong Kong

More good news about olive oil: it is good for the environment as well as for human health, because olive trees absorb a lot of carbon dioxide.

-

The Advisory Committee stands by the panel test

At the 51st meeting of the Advisory Committee of the International Olive Council (IOC), "the Advisory Committee addressed a number of questions and reaffirmed the validity of the panel test for the organoleptic assessment of virgin olive oils, calling for its reinforced application and protection from false reports which helped neither the sector nor the Organisation."

-

Greek Professor, Team Invent Mini Olive-Oil Mill, Quality Tester

A Greek professor’s invention helps olive farmers decide the best time to harvest their olives to optimize the health benefits and quantity of their olive oil.

-

Olive Oil production and consumption up by 1 million tonnes in the last 25 years

The International Olive Council (IOC) discusses worldwide olive oil production and consumption trends.

-

When xylella hits your neighbor's door

The Greek Ministry of Agriculture and Food has notified regional and local authorities about the outbreak in Spain, and vigilance is necessary in Greece.

-

International Olive Council's Market Newsletter for March 2018

Following a discussion of historical and current olive and olive oil production in Jordan, the newsletter continues to a discussion of olive oil and olive imports into selected countries from September or October to January and concludes with a summary of olive oil producer price trends in major producing countries. Extra virgin olive oil producer prices decreased in Spain and Greece over the last few weeks and remained stable in Italy, with prices in all three countries (especially Italy) lower than during the same period last year.

-

A New Generation Leads Laconiko to Excellence

The story of the Pierrakos family, Greek immigrants to the USA who dedicated themselves to producing and bottling high quality 100% Greek extra virgin olive oil before many Greeks had started doing that.

-

International Olive Council's Market Newsletter for February 2018

The International Olive Council’s February Market Newsletter opens with a spotlight on the Japanese olive oil market, noting growth in its import market since 1991 and in consumption since 1997 and discussing Japanese olive oil production, imports, consumption, knowledge, and interest in quality. (Only 1% of the olive oil imported into Japan comes from Greece.) The newsletter then turns to worldwide trade in olive oil and table olives, noting slight increases and larger decreases in imports of olive oil and olive pomace oil from October to December 2017 in several key countries, and a 40% increase in imports into the EU, especially from Tunisia, Argentina, and Morocco. Table olive imports also fell in several countries. Recently, producer prices for olive oil decreased slightly in Spain, Italy, Greece, and Tunisia, with the first three countries’ prices all lower than a year ago (especially Italy’s).

-

Report Advises Greek Exporters to Innovate

This is a summary of an in-depth study of olive oil in the American market. The study was drafted by the Greek Embassy's Office of Economic and Commercial Affairs.

-

Greek Olive Variety Makri Awaiting EU PDO Status

As Isabel Putinja write for Olive Oil Times, "Makri is an indigenous Greek olive variety cultivated in Alexandroupoli in northeastern Greece close to the border with Turkey, a region located in the western part of the geographical and historical region known as Thrace. An application was submitted to the European Commission on January 11 to include the Greek olive variety “Elaiolado Makris” (also often called “Makri”) on the EU’s list of food products with Protected Designation of Origin (PDO) status."

-

Stopping Xylella a ‘Top Priority,’ Greek Official Says

As Costas Vasilopoulos writes for Olive Oil Times, Xylella fastidiosa has not been detected in Greece, and the government is determined to keep it out.

-

International Olive Council's Market Newsletter for January 2018

The International Olive Council’s (IOC’s) Market Newsletter for January opens with a reference to the IOC’s Olive Oil Promise promotional campaign, which was launched in the USA last month at a scientific conference at the University of California at Davis that focused on olive oil’s health benefits. (A link is provided with abstracts of the papers presented there.) The newsletter discusses and graphs the growth in imports of olive oil over the last 25 years in the USA, the world’s leading importer of olive oil. Increasing imports of bulk olive oil in the USA are noted and graphed, with most coming from Spain. Graphs also indicate the amounts of different types of olive oil imported into the USA in recent years, with extra virgin leading. The newsletter then summarizes key points about world trade in olive oil and table olives, noting a decrease in olive oil imports in several major markets (especially China) in October and November. Extra virgin olive oil producer prices have changed slightly in Spain and Greece but decreased 29% in Italy and 12% in Tunisia compared to last year.

-

Creation of the 'Olive Encyclopedists Society'

The co-writers of the "Olive Encyclopedia: The olive oil" announced on January 23rd the establishment of the "Olive Encyclopedists Society," starting with 29 distinguished scientists interested in interdisciplinary collaboration focused on olives and olive oil. The society supports cooperation among academics, the olive oil industry, and olive growers to foster innovation. Other scientists who share these goals will be invited to join the society later, as well.

-

International Olive Council's Market Newsletter for December 2017

This newsletter discusses the growing worldwide production and consumption of table olives, which was noteworthy, for example, in Greece, which is also increasing table olive production this year by 31% compared to last year. It also mentioned the health benefits of olives and olive oil sales in the previous crop year. The newsletter concluded with an overview of olive oil producer price trends in the main producing countries through the end of December, with prices stable in Spain, falling in Italy and Tunisia, and falling, then stable, in Greece.

-

New Project in Greece Aims to Decrypt Domestic Olive Cultivars

As Olive Oil Times reports, "Greece seeks to analyze the genome of olives to safekeep its cultivars and make better products."

-

Greek olive oil campaign draws on the passion of its producers